The Only Guide for Feie Calculator

Wiki Article

Not known Details About Feie Calculator

Table of ContentsThe Facts About Feie Calculator UncoveredThe Of Feie CalculatorThe Greatest Guide To Feie CalculatorThe Best Strategy To Use For Feie CalculatorFeie Calculator Can Be Fun For Everyone

United States expats aren't restricted only to expat-specific tax obligation breaks. Commonly, they can claim a number of the same tax obligation credits and deductions as they would certainly in the United States, including the Child Tax Obligation Credit (CTC) and the Lifetime Discovering Debt (LLC). It's possible for the FEIE to decrease your AGI so a lot that you do not get approved for particular tax credit scores, however, so you'll require to confirm your qualification.

The tax obligation code claims that if you're a united state citizen or a resident alien of the USA and you live abroad, the internal revenue service tax obligations your around the world revenue. You make it, they tax it no matter where you make it. But you do get a wonderful exclusion for tax obligation year 2024.

For 2024, the maximum exemption has been raised to $126,500. There is additionally a quantity of competent housing expenditures qualified for exclusion.

Unknown Facts About Feie Calculator

You'll have to figure the exclusion initially, due to the fact that it's restricted to your international earned income minus any international housing exclusion you assert. To receive the foreign made income exemption, the foreign real estate exclusion or the international housing deduction, your tax obligation home need to be in an international country, and you should be just one of the following: A bona fide local of an international nation for a continuous period that consists of an entire tax year (Authentic Local Examination).for a minimum of 330 complete days throughout any type of period of 12 successive months (Physical Presence Examination). The Authentic Citizen Test is not appropriate to nonresident aliens. If you declare to the international government that you are not a citizen, the examination is not satisfied. Eligibility for the exemption can additionally be influenced by some tax obligation treaties.

For United state citizens living abroad or gaining income from foreign article resources, questions frequently occur on just how the United state tax obligation system uses to them and how they can make certain compliance while decreasing tax obligation. From understanding what foreign revenue is to browsing numerous tax obligation types and reductions, it is vital for accounting professionals to understand the ins and outs of United state

The 5-Second Trick For Feie Calculator

Jump to Foreign income is defined as any income any kind of from sources outside of the United States.

It's important to identify international earned revenue from various other kinds of international income, as the Foreign Earned Revenue Exclusion (FEIE), a useful U.S. tax obligation benefit, particularly puts on this category. Investment revenue, rental earnings, and passive revenue from international resources do not qualify for the FEIE - FEIE calculator. These sorts of income may be subject to different tax therapy

resident alien who is a citizen or person of a country with nation the United States has an income tax revenue in effect and result is a bona fide resident of citizen foreign country international nation for nations uninterrupted period that includes an entire tax year, or A U.S. citizen or person U.S.

Foreign united state income. You have to have a tax home in an international nation.

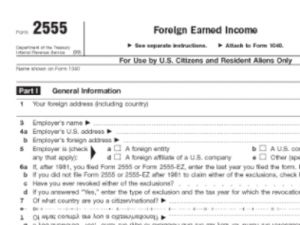

This credit can counter your United state tax responsibility on foreign income that is not qualified for the FEIE, such as financial investment income or passive revenue. If you do, you'll then submit extra tax kinds (Type 2555 for the FEIE and Type 1116 for the FTC) and connect them to Type 1040.

All about Feie Calculator

The Foreign Earned Income Exclusion (FEIE) allows eligible people to omit a part of their international made income from united state taxes. This exemption can dramatically minimize or get rid of the united state tax obligation obligation on international income. The particular quantity of international earnings that is tax-free in the U.S. under the FEIE can transform yearly due to rising cost of living modifications.Report this wiki page